Understanding VR Porn Network Types and Categories

Last Updated: 2025

The VR porn industry isn't one-size-fits-all. Networks organize themselves around three fundamental business models, each serving different priorities. Understanding these categories helps you identify which platforms actually match what you're looking for—whether that's maximum variety, consistent quality, or deep niche exploration. This guide breaks down how mega-aggregators, studio networks, and niche specialists operate differently.

The Three Primary Network Categories

VR porn networks built their businesses around distinct models that determine everything from content acquisition to pricing structures. These categories emerged as the industry matured from early experimental phases into established commercial operations with clear market positioning.

Mega-aggregators license content from hundreds of studios, studio networks produce original exclusive material, and niche specialists focus intensely on specific categories or fetishes. Each model presents unique tradeoffs. Our comprehensive network rankings compare specific platforms within each category to identify top performers.

Mega-Aggregators: The One-Stop Libraries

How the Business Model Works

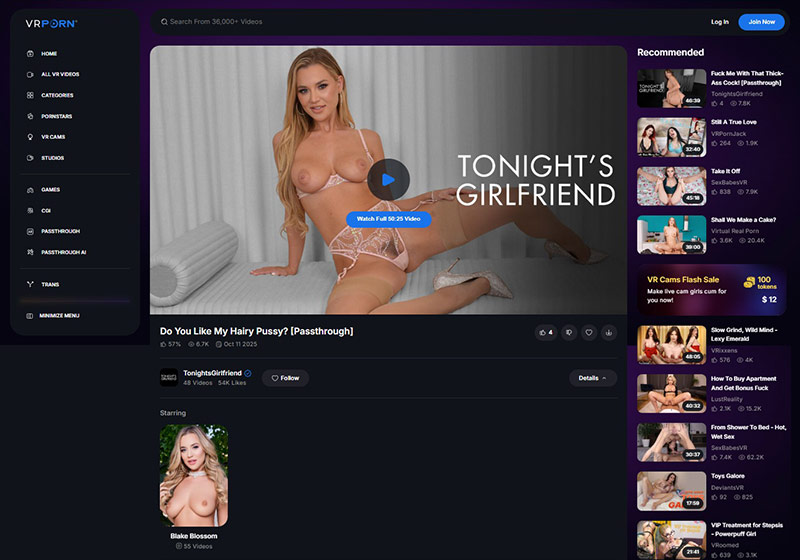

Mega-aggregators function as content marketplaces, licensing scenes from dozens to hundreds of independent studios rather than producing original material. This creates massive libraries where users access thousands of scenes under single subscriptions. Networks like VRPorn.com (34,689 scenes from 371 channels) and POVR (24,770 scenes from 115 studios) exemplify this category's scale ambitions.

The licensing approach allows rapid library growth without production costs. Aggregators negotiate bulk deals with studios, securing rights to distribute existing content across their platforms. This strategy prioritizes breadth over depth, appealing to users wanting maximum variety rather than cohesive aesthetic visions. Studios benefit from additional distribution channels and revenue streams beyond direct sales.

Quality and Consistency

Quality varies significantly across aggregated libraries. Premium 8K productions from established studios like CzechVR or WankzVR share platforms with older 4K content from smaller producers. Users navigate mixed technical specifications, production values, and performer rosters depending on source studios. This inconsistency represents aggregators' primary weakness compared to unified studio networks.

Aggregators typically organize content by studio tags, allowing users to filter preferred producers once identified. The "Studios" browsing feature essentially transforms aggregators into curated marketplaces where consumers sample different production styles before gravitating toward favorites. However, this discovery process requires patience and willingness to encounter mediocre content alongside premium productions.

Pricing and Value

Aggregators deliver maximum scenes per dollar. Services like POVR offer approximately $0.27 per day on annual subscriptions. This value proposition appeals strongly to budget-conscious consumers and genre explorers wanting broad sampling without multiple subscriptions. Lifetime membership options eliminate recurring billing while securing permanent access to continuously growing libraries.

The tradeoff involves download limits on some platforms (VRPorn.com restricts to 20 daily downloads) and less comprehensive feature support. Teledildonic integration and advanced interactive elements often lag behind specialized studio networks prioritizing cutting-edge technology. Aggregators focus resources on content licensing rather than proprietary feature development.

Best For

- Users exploring VR porn for first time, wanting genre variety

- Budget-conscious subscribers maximizing content per dollar

- Viewers sampling different studios before specialized subscriptions

- Consumers preferring convenience of single login across studios

Leading Mega-Aggregators Compared

| Network | Total Scenes | Studios | Daily Updates | Key Feature |

|---|---|---|---|---|

| VRPorn.com | 34,689 | 371 | Yes | Largest variety |

| POVR | 24,770 | 115 | Yes | Best value |

| Real VR | 1,223 | 29 | No | Curated quality |

Premium Studio Networks: Consistent Quality

Original Production Focus

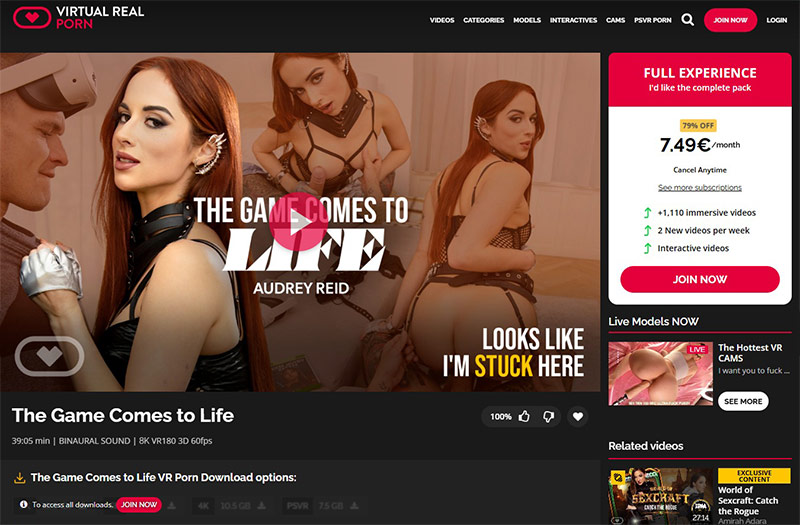

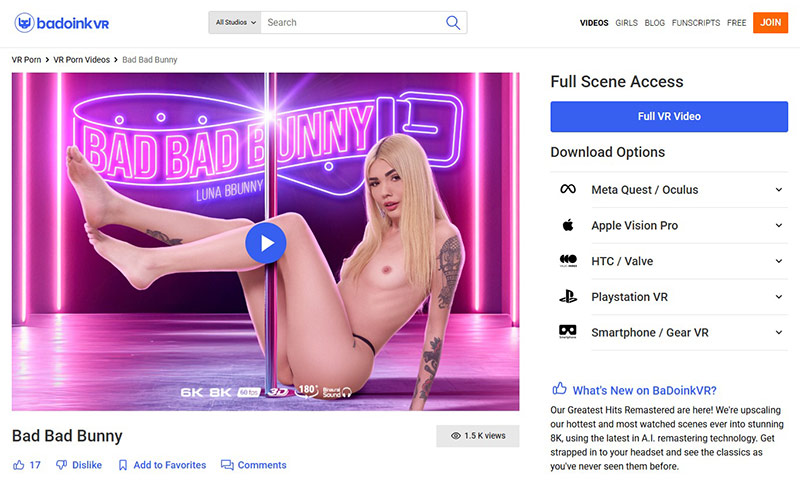

Studio networks invest in original content production, maintaining in-house teams for filming, direction, and post-production. This vertical integration creates consistent production quality, unified aesthetic visions, and recognizable brand identities. Networks like Virtual Real Porn, BaDoink VR, and VR Bangers built reputations through reliable technical excellence and regular update schedules.

Original production allows experimentation with advanced features unavailable to aggregators. Studios pioneer teledildonic integration, develop proprietary VR player applications, and implement interactive elements like multi-angle viewing or branching narratives. These innovations position studio networks as premium options justifying higher subscription costs through feature sophistication beyond basic video playback. Understanding broader VR technology trends helps users identify which studios lead in technical innovation.

Production Standards

Studio networks maintain consistent technical specifications across libraries. Users expect reliable 7K-8K resolution, 60fps framerates, and binaural audio as baseline standards rather than hit-or-miss qualities found in aggregated content. Professional lighting, experienced performers, and polished set design create cohesive viewing experiences aligning with established brand expectations.

This consistency comes at the cost of smaller libraries. Studio networks typically offer 800-1,500 scenes compared to aggregators' tens of thousands. Production timelines and budgets limit output to 2-5 new scenes weekly rather than daily bulk additions. Users trade volume for reliability, knowing each scene meets minimum quality thresholds.

Innovation and Feature Leadership

Studio networks drive industry innovation through proprietary technology development. Virtual Real Porn pioneered VirtualRealPlayer app with integrated teledildonic support. BaDoink VR developed VR Theater Mode for immersive browsing. VR Bangers introduced Head Rig 2.0 camera systems optimizing POV positioning. These advances establish competitive differentiation beyond content volume.

Feature development requires significant investment, explaining premium pricing compared to aggregators. Monthly subscriptions typically run $25-35 at standard rates, though promotional discounts and annual commitments reduce per-month costs.

Best For

- Users prioritizing consistent quality over maximum variety

- Tech enthusiasts wanting cutting-edge VR features

- Subscribers who identified preferred production styles

- Viewers valuing polish and professional presentation

Leading Studio Networks Compared

| Network | Total Scenes | Updates/Week | Resolution | Special Feature |

|---|---|---|---|---|

| Virtual Real Porn | 1,110 | Several | Up to 8K | Teledildonics |

| BaDoink VR | 969 | 2 | Up to 8K | VR Theater Mode |

| VR Bangers | 828 | Several | Up to 8K | Head Rig 2.0 |

Niche Specialists: Focused Category Experts

Deep Category Exploration

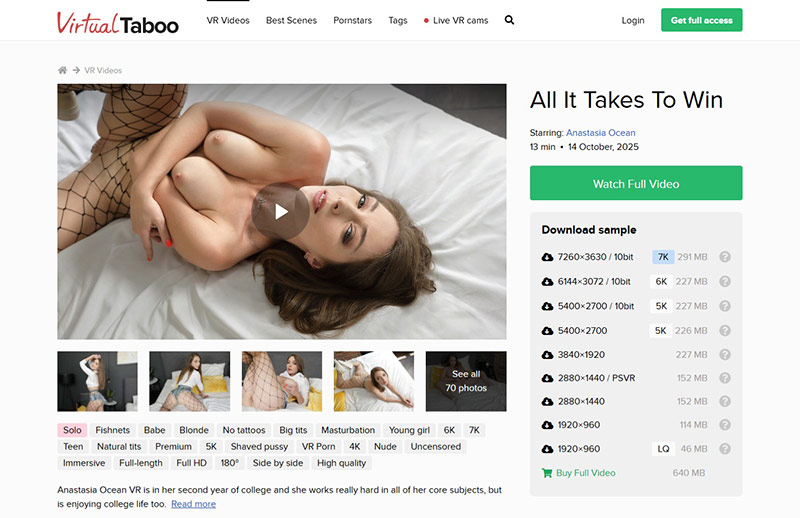

Niche specialists concentrate exclusively on specific content categories, fetishes, or demographics rather than attempting broad appeal. Networks like Virtual Taboo (taboo roleplay), VR Cosplay X (character-based content), and TMW VR NET (European performers) serve dedicated audiences seeking category depth unavailable from general platforms. This specialization allows authentic expertise in specific niches.

Focused production teams develop nuanced understanding of niche preferences, casting decisions, and scenario authenticity. Performers and directors specialize in category conventions, avoiding the superficial treatment niche content often receives in broader networks. Dedicated audiences appreciate this attention to detail and genre fidelity missing from mainstream studios dabbling in niche categories.

Library Size and Updates

Niche networks maintain smaller libraries (typically 500-1,500 scenes) concentrated within specialty categories. This limited scope proves acceptable to target audiences valuing category depth over cross-genre variety. Update schedules vary from weekly to several times weekly, maintaining steady content flow without overwhelming subscribers exploring focused categories thoroughly.

The specialized approach creates inherent limits on total addressable market. Networks targeting specific fetishes or demographics necessarily serve smaller subscriber bases than mainstream platforms. This reality explains premium pricing relative to content volume—niche networks charge higher per-scene costs but deliver category authenticity justifying premiums for dedicated enthusiasts.

Pricing Models

Niche specialists typically price between mid-tier and premium levels ($20-30 monthly), though some offer competitive annual rates. Virtual Taboo's $250 lifetime option provides exceptional value for dedicated taboo content consumers, while VR Cosplay X's premium pricing reflects costume and set production costs. Subscribers effectively pay premiums for category expertise rather than raw content volume.

Many niche networks bundle discount access to partner sites, effectively expanding libraries beyond core specialties. Virtual Taboo members receive 75% off sister site DarkRoomVR and discounts across 10+ partner networks. These partnerships acknowledge that niche audiences often maintain multiple subscriptions, making cross-promotions mutually beneficial.

Best For

- Users with established specific fetishes or preferences

- Viewers seeking authentic category representation

- Subscribers willing to pay premiums for expertise

- Audiences underserved by mainstream content

Leading Niche Specialists Compared

| Network | Specialty | Total Scenes | Updates | Unique Aspect |

|---|---|---|---|---|

| Virtual Taboo | Taboo roleplay | 1,311 | Several/week | Partner discounts |

| VR Cosplay X | Character roleplay | 490 | Weekly | Premium costumes |

| TMW VR NET | European focus | 794 | Several/week | 35 channels |

Hybrid Models and Multi-Studio Aggregators

Some networks blend characteristics across categories, creating hybrid models serving intermediate positions. Real VR exemplifies this approach: aggregating content from 29 carefully selected studios rather than hundreds, it positions between massive aggregators and single-studio networks. This curated aggregation emphasizes quality filtering over maximum volume.

Multi-studio aggregators apply editorial standards to licensing decisions, partnering only with studios meeting technical and production thresholds. Users benefit from variety exceeding single studios while avoiding quality inconsistency plaguing all-inclusive aggregators. This middle-ground approach appeals to viewers wanting diverse content without wading through mediocre productions.

Baberotica VR demonstrates another hybrid approach: aggregating 11 channels while maintaining unified aesthetic vision emphasizing artistic cinematography and sensual presentation over hardcore intensity. The network essentially curates studios sharing similar production philosophies, creating thematic consistency despite multi-studio sourcing.

When Hybrid Models Make Sense

Hybrid networks suit users overwhelmed by mega-aggregator volume but wanting more variety than single studios provide. The curated approach reduces discovery friction, helping subscribers identify satisfying content faster than massive unfiltered libraries. Premium pricing relative to all-inclusive aggregators reflects editorial curation and quality assurance efforts.

Emerging Trends and Future Categories

The VR porn industry continues evolving beyond traditional category definitions as technology enables new content formats and interaction paradigms. Interactive narratives allowing viewer choice-driven storylines represent one emerging category, though current adoption remains limited. Networks experimenting with branching scenarios create replayability through multiple plot paths based on user decisions.

Augmented reality integration blurs lines between VR and real-world environments, creating hybrid experiences distinct from pure VR. Passthrough features on modern headsets enable AR functionality without requiring separate hardware investments. Live VR experiences represent another category gaining traction, where performers interact with viewers in real-time through VR interfaces rather than pre-recorded content. This synchronous model creates spontaneity and personalization impossible in traditional subscription networks, though technical requirements and per-session pricing create different economics than monthly subscriptions.

Understanding the broader context of virtual reality technology helps situate VR networks within larger market dynamics. VR remains relatively niche within total adult content consumption, though growth trajectories suggest increasing mainstream adoption as headset prices decline and content libraries expand. Resources like Wired's VR coverage track these developments across entertainment sectors.

Choosing the Right Network Category

Selecting appropriate network categories depends on personal priorities around content variety, quality consistency, budget constraints, and niche interests. Many experienced users maintain subscriptions across multiple categories: an aggregator for broad exploration, a studio network for reliable quality, and potentially a niche specialist matching specific preferences.

Budget-conscious consumers often start with aggregators maximizing initial value while identifying preferred genres and production styles. After determining preferences, transitioning to studio networks or niche specialists makes sense when consistent quality or category depth outweigh variety benefits. This staged approach prevents expensive mismatched subscriptions while building knowledge of personal preferences.

Category Selection Framework

- Choose Aggregators if: Exploring VR porn broadly, wanting maximum variety, operating on tight budget, sampling before specialized subscriptions

- Choose Studio Networks if: Identified preferred production styles, prioritizing consistent quality, wanting cutting-edge features, appreciating professional polish

- Choose Niche Specialists if: Have specific fetishes/preferences, seeking authentic category representation, willing to pay premiums for expertise, underserved by mainstream content

- Choose Hybrid Models if: Want variety with quality assurance, overwhelmed by massive libraries, prefer curated selections, need middle-ground options

For comprehensive comparisons of specific networks within each category, our detailed network rankings analyze individual platforms' strengths and weaknesses. Sites like VRPornExpert provide additional technical reviews and comparison tools. Understanding category characteristics provides framework for evaluation, while specific network reviews identify which platforms execute their category strategies most effectively.

Frequently Asked Questions

Can I subscribe to multiple network categories simultaneously?

Yes, many experienced users maintain subscriptions across categories. Common combinations include one aggregator for variety plus one studio network or niche specialist matching specific interests. Annual subscriptions across multiple networks often cost less combined than single premium monthly subscriptions.

Do aggregators pay studios fairly for licensed content?

Licensing economics vary, but studios voluntarily partner with aggregators for additional revenue streams and exposure beyond direct sales. Some studios report aggregator licensing covers production costs while direct sales generate profits. The relationship remains mutually beneficial or studios would decline partnerships.

Why do studio networks cost more despite smaller libraries?

Original production costs significantly exceed licensing fees. Studios invest in equipment, performers, sets, post-production, and feature development. Premium pricing reflects these investments plus smaller subscriber bases compared to aggregators' volume advantages. Users essentially pay for consistent quality and innovation.

Are niche specialists worth premium pricing for casual viewers?

Generally no. Niche specialists serve dedicated enthusiasts for whom category authenticity justifies premium costs. Casual viewers exploring categories occasionally should start with aggregators including niche sections. Transition to specialists only after confirming sustained interest warranting focused subscriptions.

Do network categories correlate with technical quality?

Partially. Studio networks and niche specialists typically maintain higher minimum technical standards than aggregators due to unified production control. However, top aggregated studios match or exceed some network originals. Category indicates quality consistency more than absolute technical ceilings.

How often should I reevaluate my network category choices?

Review subscriptions quarterly or after exhausting current network content that interests you. Preferences evolve, new networks launch, and existing platforms improve offerings. Periodic reassessment prevents paying for subscriptions no longer matching current interests while identifying better-suited alternatives.

Can network categories change over time?

Yes, some networks evolve strategies. Aggregators sometimes launch original productions, while studios may license complementary content. However, core business models typically remain stable as they require different operational structures and expertise. Major category transitions remain rare.

Explore Networks by Category

Now that you understand VR porn network categories and their distinct characteristics, explore our rankings to find specific platforms matching your preferences within each type.

View Complete Rankings